L'évaluation immobilière

Real estate valuation is an essential process that relies on several key steps to determine the value of a property. Each step plays a fundamental role in the analysis and accuracy of the final estimate.

Preparation in advance: collection of crucial documents

Everything begins well before the property visit. The first step of the real estate valuation process is to establish initial contact with the client in order to gather all documents related to the property.

This includes elements such as:

Building plans

Energy Performance Certificate (EPC)

Urban planning file

Electrical compliance certificates

Oil tank tightness certificate (for underground tanks over 3000L)

This phase of information gathering is crucial, as it provides a complete view of the property to be valued, thereby ensuring an accurate assessment.

Site observation

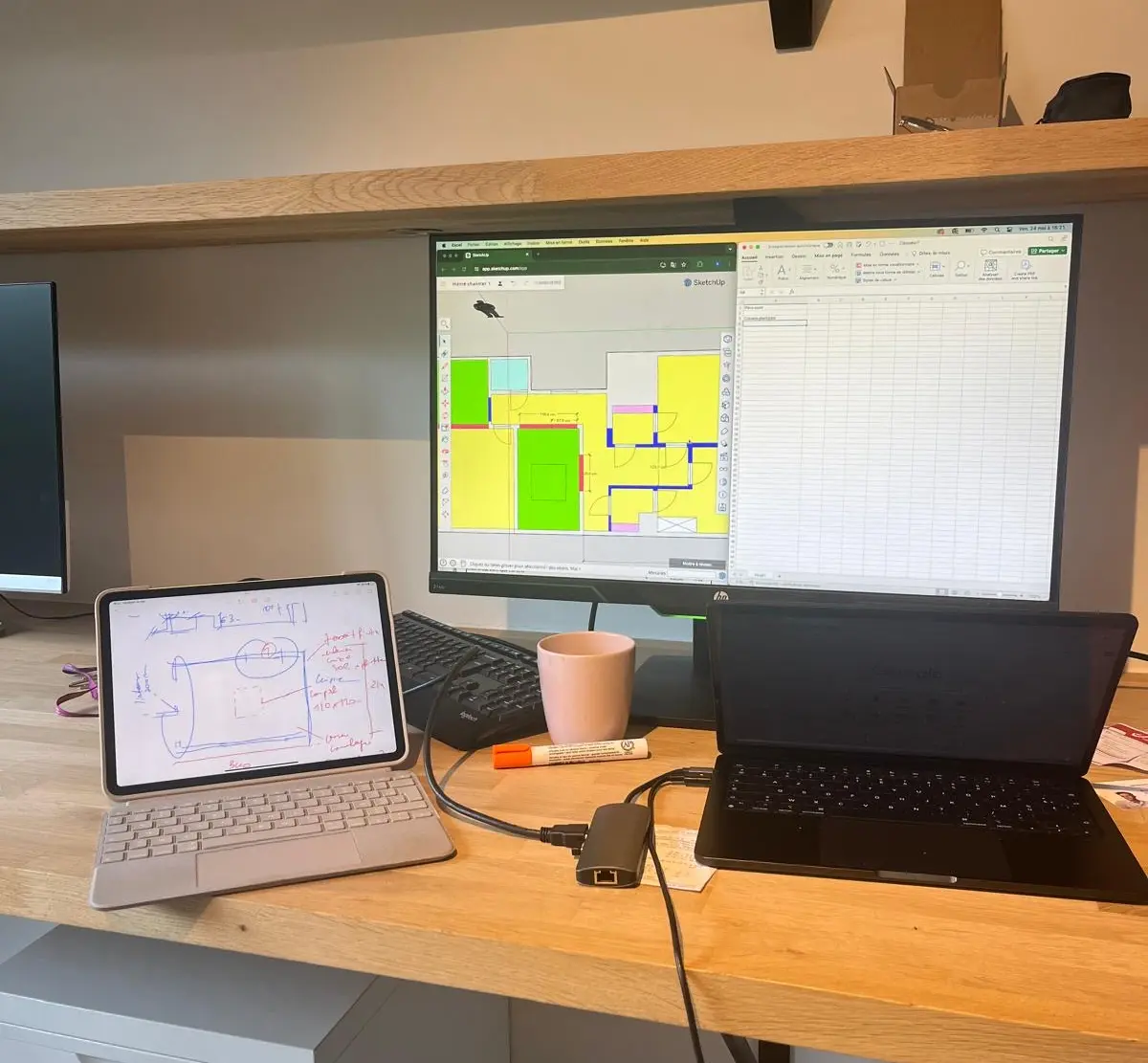

Once on site, the expert carefully observes every detail.

During this visit, he takes a photo report. In the absence of plans, measurements will be taken, as well as an assessment of urgent and necessary maintenance work to be considered.

The environment of the property is also an essential criterion in the valuation. Whether the property is located in a rural, industrial, or residential area, the proximity to amenities and infrastructure contributes to the overall context analysis of the property.

Contextual evaluation

After the visit, the majority of the work continues in the office. The expert conducts various administrative research tasks to:

- Locate the cadastral parcel

- Identify zoning areas and flood risk zones

- Identify nearby amenities

In parallel, he prepares an inventory of the advantages and disadvantages of the property, whether they are related to its intrinsic characteristics or its environment.

This contextual evaluation is essential for achieving a reliable and well-substantiated estimate.

Property Valuation

The final step of the real estate valuation is the property valuation. Several calculation methods are used to achieve an accurate estimate:

Capitalization method

Based on rental yield.

Comparison point method (Market value)

Taking into account the price per square meter of similar properties.

Intrinsic value method (Actual value)

Based on the reconstruction cost of the property, from which depreciation is deducted.

The choice of methods will depend on the type of property being assessed. All of these approaches ensure a precise and reliable expertise.

In conclusion

The real estate valuation process enables the expert to provide an accurate, justified, and contextualized estimate of a property's value, thereby meeting the client's expectations.

The calculation methods are based on numerous objective factors, ensuring a realistic value that is consistent with the market.

By engaging an expert, you ensure a reliable valuation based on their technical skills and in-depth knowledge of the real estate market.

Feel free to contact us for your property evaluations anywhere in Belgium!

Schedule your appointment with BEREX quickly!